Kearney Launches New Tax Incentives for Property Improvements

/The City of Kearney has introduced an exciting new program to encourage property improvements in the downtown area and surrounding neighborhoods. The K-353 Redevelopment Corporation is now accepting applications for its Chapter 353 tax abatement program, designed to help revitalize eligible residential and commercial properties.

The all-new K-353 Redevelopment Plan targets a 215-acre area generally known as Original Kearney,

The Board of Aldermen recently approved the program under Chapter 353 RSMO, a state statute that permits cities to abate real property taxes for specific improvements in a designated geographical area. The all-new K-353 Redevelopment Plan targets a 215-acre area (see attached boundary map) generally known as Original Kearney, encompassing 317 parcels of residential and commercial properties. The program aims to combat blight, enhance the city’s existing housing stock and attract new businesses and multi-family developments to a resurgent downtown.

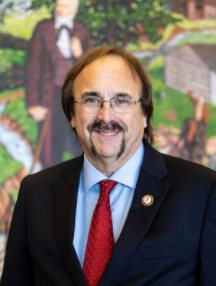

“This area is the cornerstone of our city’s identity,” said Mayor Randy Pogue. “Many buildings here date back to the late 1800s and early 1900s. This program provides a unique opportunity to preserve our community’s heritage by offering attractive tax incentives for property owners who choose to rehabilitate and enhance their properties. We are confident this initiative will inspire new investment, bringing renewed energy to the neighborhood and our city as a whole.”

The K-353 Redevelopment Plan offers eligible applicants 100% real property tax abatement on new improvements for up to 15 years, effectively freezing property taxes at their pre-improvement level. The program features four levels of tax abatement based on the scope of investment and the type of improvements made:

• Level A-1: Investments of $15,000–$24,999, requiring all improvements to be exterior.

• Level A-2: Investments of $25,000-$149,999, requiring 50% of improvements to be exterior.

• Level B: Investments of $150,000-$749,999, requiring 50% of improvements to be exterior.

• Level C: Investments of $750,000 or more, requiring 50% of improvements to be exterior.

Tax abatement is activated once the approved project is completed.

The program’s Policy and Guidelines are available at City Hall, 100 E. Washington St., and can also be downloaded from the city’s website at www.kearneymo.us. For more information, contact the Economic Development Department at 816-551-3008.

KPGZ News – City of Kearney contributed to this story.